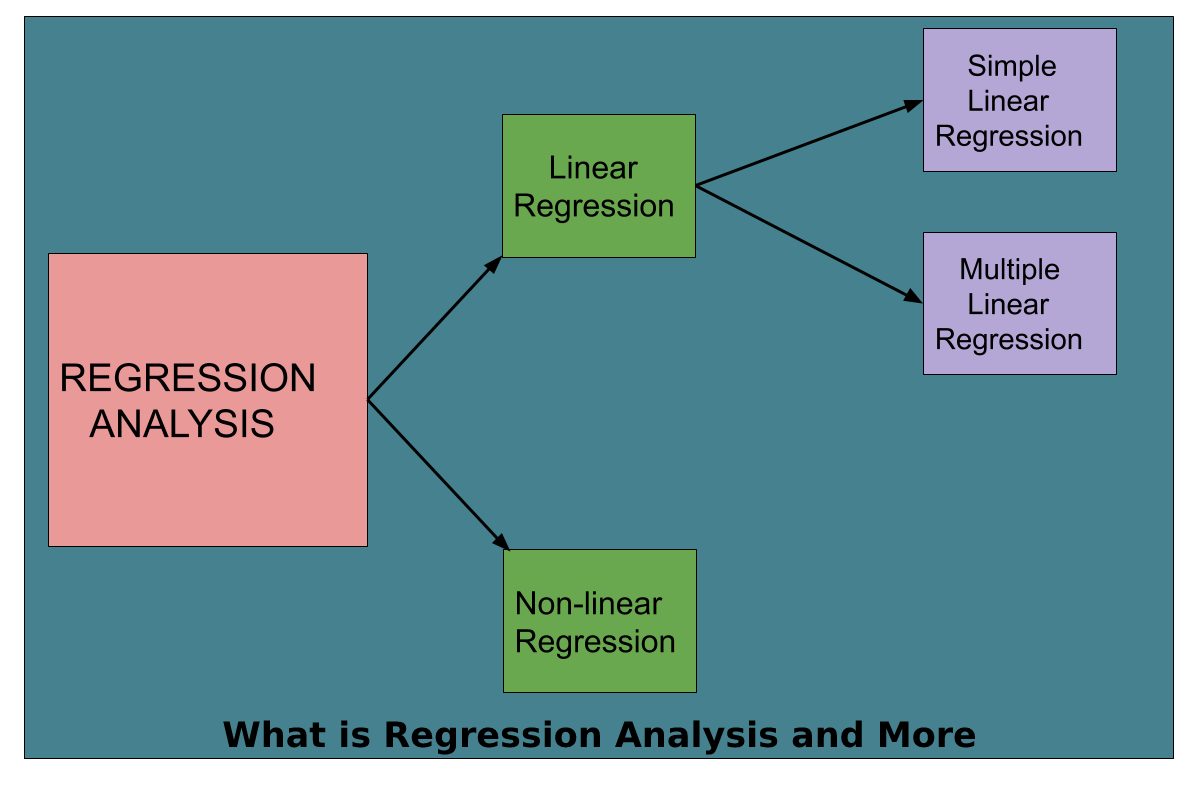

01 Apr What is Regression Analysis and More

Table of Contents

Introduction

Regression analysis is a set of statistical approaches used to estimate the relationships between a dependent variable and one or more independent variables. It can remain used to evaluate the strength of the relationship between variables and to model the upcoming relationship between them.

Regression analysis includes variations, such as linear, multiple, and nonlinear. The most common models are single linear and multiple linear. However, nonlinear regression analysis remains commonly used for more complicated data sets in which dependent and independent variable quantities show a nonlinear relationship.

Regression analysis offers many applications in various disciplines, including finance.

Regression Analysis – Linear Model Assumptions

The linear regression analysis remains based on six fundamental assumptions:

- Dependent and independent variable quantity shows a linear relationship between slope and interception.

- The independent variable is not random.

- The value of residual value (error) is zero.

- The residual value (error) is constant across all observations.

- The residual value (error) remains not correlated in all observations.

- Residual values (error) follow the normal distribution.

Regression Analysis – Simple Linear Regression

Simple linear regression is a model that evaluates the relationship between a dependent variable and an independent variable. For example, the following equation expresses the simple linear model:

Y = a + bX + ϵ

Where:

- Y – Dependent Variable

- X – Independent variable (explanatory)

- Interception

- b – Pending

- ϵ – Residual (error)

Regression Analysis – Multiple Linear Regression

The multiple linear regression analysis is essentially similar to the simple linear model, except that numerous independent variables remain used in the model. The mathematical picture of multiple linear regression is as follows:

Y = a + bX1 + cX2 + dX3 + ϵ

Where:

- Y – Dependent Variable

- X1, X2, X3 – Independent variables (explanatory)

- Interception

- b, c, d – Earrings

- ϵ – Residual (error)

Multiple linear regression follows the same situations as the simple linear model. However, since there are some independent variables in the multiple linear analysis, there is another mandatory condition for the model:

- Non-collinearity: Independent variables should show minimal correlation with each other. If the independent variables remain highly correlated, it will be difficult to assess the relations between the dependent and independent variables.

Also Read: Types of Treadmills Buying Guide 2022

Regression Analysis In Finance

Regression analysis comes with many applications in finance. For example, the statistical method is central to the capital strength pricing model (CAPM). The CAPM calculation is a model that determines the relationship between an asset’s expected return and the market risk premium.

The analysis remains also used to forecast returns on securities based on different factors or to forecast the performance of a business. Learn more forecasting methods in the CFI Forecasting and Budgeting course!

- Beta and CAPM

In finance, regression analysis remains used to calculate a stock’s beta (return volatility relative to the overall market). It can remain done in Excel by resources of the Pending function.

- Estimated revenue and expenditure

When forecasting a company’s financial statements, it may be helpful to do a multiple reversion analysis to control how changes in certain assumptions or business drivers will affect future revenue or expenses. For example, there can be a very high correlation between the number of sellers employed by a company, the number of stores operating, and the revenue generated by the business.

Conclusion

Excel is still a popular tool for performing fundamental regression analysis in finance. However, many more advanced statistical tools can remain used.

Python and R are powerful coding languages that have become popular for all types of financial modeling, including regression. In addition, these techniques form a central part of data science and machine learning, where models remain trained to detect these relations in data.

Learn more about reversion analysis, Python, and Machine Learning in CFI Business Intelligence and Data Analysis certification.

Also Read: What are Internal Combustion Engines

No Comments